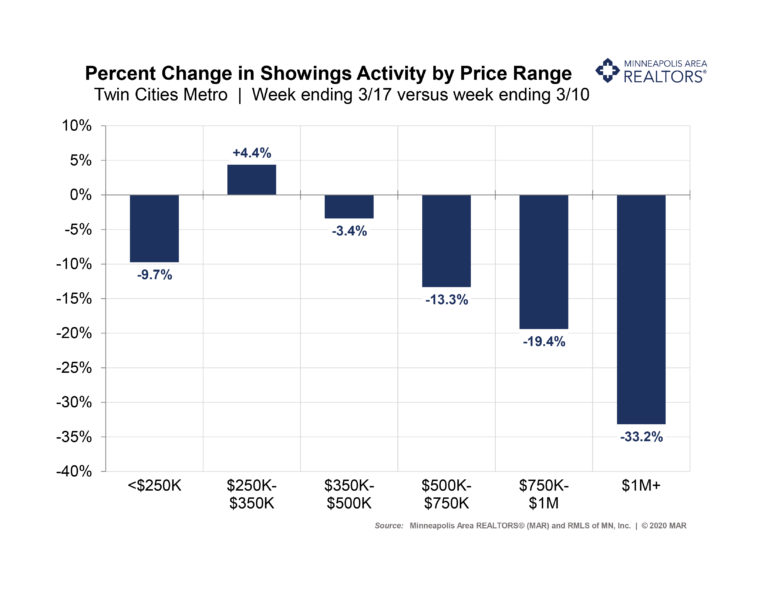

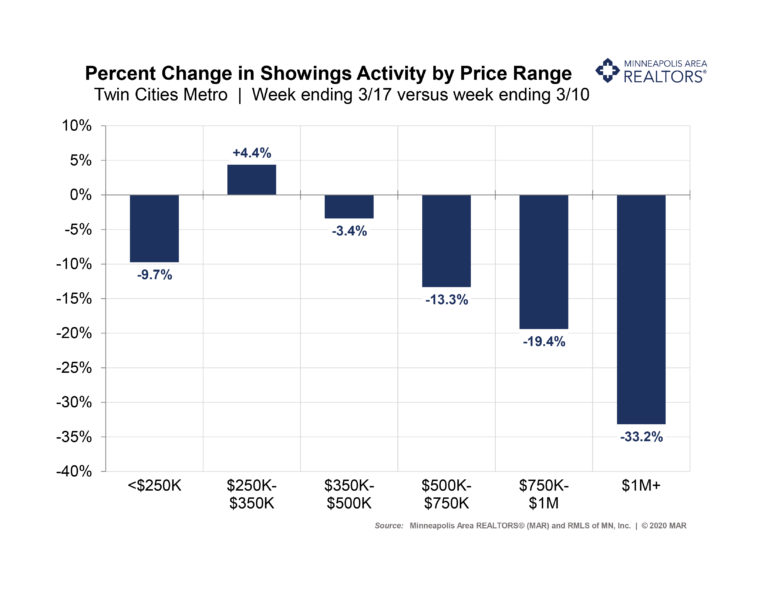

New data reveals fewer residential showings across most price ranges

(March 19, 2020) – According to new data from the Saint Paul Area Association of REALTORS® and the Minneapolis Area REALTORS®, the number of Twin Cities residential real estate showings declined in most price ranges during the week ending March 17 compared to the previous week. The declines, which come amid the coronavirus pandemic, were most prominent in the higher price brackets.

Showings decreased by 9.7% in the under $250,000 price bracket, where inventory is down significantly. The in-demand $250,000 to $350,000 price range was the only one that had an increase in showings. Homes priced over $1million saw a 33.2% decline in showings.

“It appears that concerns about spreading the coronavirus are starting to have an impact on our market,” said Patrick Ruble, President of the Saint Paul Area Association of REALTORS®. “REALTORS® are encouraged to follow the most current best practices in accordance with their brokers, which should be following the CDC guidelines. This includes activities such as open houses, active listings and interactions with clients and visitors.”

New listings, which are usually on the rise this time of year, have been weakening over the past couple of weeks. Active listings, or the total number of homes for sale, have also started softening in recent days. On a positive note pending sales, or the number of signed purchase agreements, remained strong during this period.

“Buyers in the more affordable price ranges embraced the low rates and mild weather,” said Linda Rogers, President of Minneapolis Area REALTORS®. “We are noticing fewer showings in the higher price points, reflecting both buyer and seller concerns and time will tell how the rest of the month plays out.”

In other news, the February numbers showed buyer and seller activity were up compared to last year. But the gains appear deceptively large due to weather challenges that held activity back in February 2019. Even so, the gains—particularly for pending sales—also outpaced 2018 levels.

Seller listing activity effectively recovered after the snow and melt we saw in 2019 and then increased slightly over 2018 levels. The nearly 24.0 percent increase in pending sales—or the number of signed purchase agreements—goes beyond weather. Mortgage rates have fallen throughout the year and spent most of February below 3.5 percent, compared to around 4.5 percent in February 2019. The Federal Reserve recently acted to further lower interest rates to limit the downside risks of COVID-19 to the economy. Home sales help the economy and low rates help to hedge against declining affordability brought on by rising prices.

February 2020 by the numbers compared to a year ago

- Sellers listed 5,293 properties on the market, a 19.9 percent increase from last February

- Buyers signed 4,267 purchase agreements, up 23.9 percent (3,016 closed sales, up 6.0 percent)

- Inventory levels declined 12.4 percent to 7,879 units

- Months Supply of Inventory was down 11.1 percent to 1.6 months (5-6 months is balanced)

- The Median Sales Price rose 6.3 percent to $282,000

- Cumulative Days on Market decreased 2.9 percent to 67 days, on average (median of 40)

- Changes in Sales activity varied by market segment

-

- Single family sales rose 4.9 percent;condo sales fell 1.4 percent; townhome sales rose 17.7 percent

- Traditional sales increased 6.9 percent; foreclosure sales rose 8.5 percent; short sales fell 5.9 percent

- Previously owned sales were up 6.3 percent; new construction sales climbed 16.8 percent

For more information on weekly and monthly housing numbers visit www.mplsrealtor.com.