Twin Cities homes sold for a higher median price than during the year prior for the 12th consecutive month. This is a significant milestone demonstrating a real and sustainable recovery. Several patterns continued from 2012: pending purchase activity was up, new and existing supply levels were down, prices were higher and distressed market activity eased.

There were 2,736 closed home sales during February 2013, 4.7 percent fewer than February 2012. There were 3,689 pending sales, a 2.0 percent increase over last year. The median sales price rose 15.5 percent to $160,000. Inventory levels declined 31.6 percent to 12,202 active listings, the lowest number for any month going back to January 2003. The number of homes for sale is at a 10-year low.

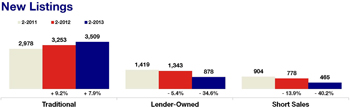

“We’re watching seller activity almost more than buyer activity,” said Andy Fazendin, President of the Minneapolis Area Association of REALTORS®. “Bank listing activity is down while traditional seller activity is up. That’s an encouraging shift.”

Looking at activity by sale type, traditional closed sales were up 21.5 percent; foreclosure sales were down 23.5 percent; short sales were down 28.5 percent. Since traditional homes sell for about 75.0 percent more than foreclosures, the median sales price rose, as it has for 12 straight months compared to year-ago levels. The 10K Housing Value Index – which controls for data variability – showed a tamer 10.2 percent increase to $179,010. Stronger confidence and less economic uncertainty will encourage more seller activity, thereby increasing the supply of homes for sale. There is evidence this is improving, as traditional seller activity has been on the rise lately.

A healing distressed segment has also facilitated recovery. At 72.3 percent, traditional homes represented more than 70.0 percent of all new listings for the first time since June 2008. Traditional homes also made up 55.4 percent of all closed sales. The traditional median sales price was up 14.2 percent to $205,500; the foreclosure median sales price was up 12.3 percent to $116,522; the short sale median sales price was up 10.1 percent to $127,750.

Months’ supply of inventory fell 40.8 percent to 2.9 months. Figures below 4.0 months suggest we’re in a fledgling seller’s market. Homes sold in 113 days, on average, or 21.5 percent quicker than February 2012. Sellers received 93.7 percent of their list price, on average, up from 90.6 percent last year. Conventional financing comprised 46.7 percent of all closed sales; FHA financing was used on 20.9 percent of sales; cash buyers made up 25.1 percent of sales.

“Judging by the number of inquiries agents are receiving, buyers seem prepared and motivated this spring,” said Emily Green, MAAR President-Elect. “We anticipate an uptick in new listings and we hope it is enough to meet the strength of buyer demand.”