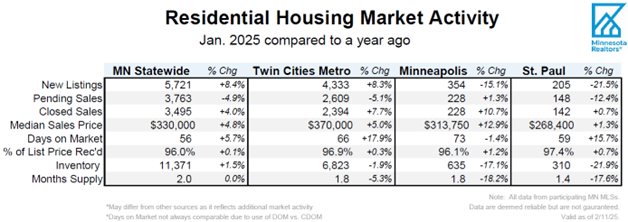

- New listings rose 8.4% statewide and 8.3% in the Twin Cities

- Signed purchase agreements fell 4.9% statewide and 5.1% in the metro

- The median sales price increased 4.8% statewide and 5.0% in the metro

(Feb. 18, 2025) – According to new data from the Minnesota state and Twin Cities metro Realtor® Associations, seller activity and home prices rose across the state and metro in January, but new buyer activity was lower.

Sellers, Buyers and Housing Supply

An inventory shortage and lack of affordability brought on by higher mortgage rates remain central themes. Mortgage rates averaged just about 7.0% throughout January—the highest level since May 2024. That pushed buyer activity lower across the state and metro, breaking a three-month streak of gains in pending sales for the state, and a four-month streak of gains for the metro. And that was just as buyers seemed to be adjusting to higher rates in recent months. Compared to last January, seller activity was up over 8.0% across both the state and metro; pending sales were down about 5.0% for both the state and metro. Sellers—whether move-uppers or downsizers—are having an easier time in this market if they can break the shackles of their low interest rate. They have plenty of equity from their last home, which has risen in value considerably over the last few years. But those sellers will find less inventory and fewer options this January than last. That said, the latest numbers show that every month of 2024 actually had more inventory than the year prior.

Many other would-be sellers still feel wed to their homes with rates as low as 2.7–4.5%, compared to 7.0% today. This lock-in effect has caused a buildup in “pent-up demand” to sell and buy, meaning as rates fall, competition will stiffen up. There are signs of recovery, but affordability remains a major hurdle. Prospective buyers are still feeling the triple punch of higher prices, higher mortgage rates, and limited inventory.

“First time buyers face the biggest hurdle while other shoppers and sellers aren’t feeling the pinch quite as much,” said Patti Jo Fitzpatrick, President of Minnesota Realtors®®. “Today’s buyers can be more patient and selective because they have more choices, but that could change as we approach the spring. The year is young.”

Prices, Market Times and Negotiations

Every area, price point, and market segment is unique. Some listings are getting multiple offers in a few days and closing for over list price, while others are being discounted or lingering on the market. On average, however, sellers accepted offers at 96.0% of list price statewide and 96.9% in the metro—both up from last year and both at their highest January level since 2022. Those offers were accepted after an average of 56 days on market statewide and 66 days in the metro—both figures up from a year ago.

“Despite some weakness in January, it feels like things are starting to change. But it’s difficult to speak to the entire metro market,” said Frank D’Angelo, President of Minneapolis Area Realtors®®. “Even downtown, prices in the Downtown East Mill District were $1.2M but then 10 blocks away Loring Park condos were selling for around $170,000.”

The statewide median home price was up 4.8% to $330,000, while the metro median price was up 5.0% to $370,000. But home prices seem to matter less than monthly payments. In fact, a typical “all-in” payment on the median priced home, including taxes and insurance, is about $2,500 statewide and $2,800 in the metro. Compare that to an $1,800 metro mortgage payment in 2021. More housing supply means less upward price pressure while a strong economy creates well-paying jobs for residents to sustain those monthly payments and keep up with repairs and maintenance.

“Despite a dip in sales, I’m still hearing more optimism these days. There’s a sense that things are slowly rebalancing,” said Jennifer Livingston, President of the Saint Paul Area Association of Realtors®®. “For better or worse, interest rates continue to drive this market. I have prospective buyers who are literally watching the rate changes day to day. Today’s buyers are very rate sensitive.”

Locational Differences | Minnesota Statewide

Market activity always varies by area, price point and property type. Regions such as Duluth and the North Shore, Rochester and Willmar saw the largest gains in seller activity. Alexandria, Willmar and Brainerd had the largest gains in pending sales. Homes sold the fastest in the Duluth/North Shore region along with St. Cloud and Rochester. Prices were highest in the metro followed by Detroit Lakes, Alexandria and Rochester. The most affordable regions of the state were Hibbing/Virginia, Willmar and Grand Rapids. Every region is undersupplied except Hibbing/Virginia, which is a balanced market.

Locational Differences | Twin Cities Metro

For cities with at least five sales, Mahtomedi, Mendota Heights and Oak Grove had the largest sales gains. The highest priced areas were Deephaven, Sunfish Lake, Independence and Tonka Bay while the most affordable areas were Little Canada, Osseo and Circle Pines. But the largest increases in prices were in Deephaven, Medina and Mendota Heights. The most oversupplied markets were Centerville, Hanover and Delano while the most undersupplied markets were Circle Pines, Mounds View and New Brighton. Homes took the longest to sell in Shorewood, Medina and White Bear Township and sold the fastest in St. Paul Park, Norwood Young America and Wyoming.