By David Arbit, Director of Research & Economics

Abstract: There is no question we are in a rising interest rate environment. The Fed may begin to normalize rates starting in December 2015. Inflation has been low, jobs numbers have been strong, wage growth is accelerating, unemployment has fallen dramatically and the U.S. is one of the few bright spots in today’s global economy. The process of rate normalization will be slow and incremental—the Fed is well aware that raising rates too quickly could threaten the recovery. It’s important to remember that there are many factors affecting consumer-facing rates other than Fed policy. Moreover, rising wages and an improving labor market could offset some of the declining affordability brought on by marginally higher rates and rising home prices. Keeping rates this low for too long poses its own set of risks. It’s tempting to be blinded by the recent past, but many consumers were lining up to get mortgages at 17.0% or higher only a few decades ago. Ultimately, higher interest rates are unlikely to derail the recovery and could even deliver some positive outcomes.

Precisely six years and six months after the official end of the Great Recession, the Federal Reserve (Fed) finally seems poised to normalize what have been the lowest interest rates in 50 years. Rates have remained low in an effort to help spur borrowing and growth for businesses and consumers, and they’ve mostly accomplished that goal without the rampant inflation feared by some hawks. That said, leaving rates this low for too long poses its own set of risks. There is a somewhat delicate balancing act.

What exactly does the Fed do? By law, the Fed has a dual mandate: maximum employment and price stability in the form of mild inflation. Excluding a bit of volatility here and there (mostly food and energy), there has been a good deal of progress on both fronts. As the Fed signals that they’re confident enough in the economy’s ability to withstand higher rates, most consumers should feel good about that assessment. Consumers—particularly prospective home buyers—should also understand that mortgage rates are expected to remain below average for years to come. In other words, some will undoubtedly rush to close on a property so they can brag about a sub-4.0% interest rate at backyard barbecues but the reality is that mortgage rates will remain attractive for some time.

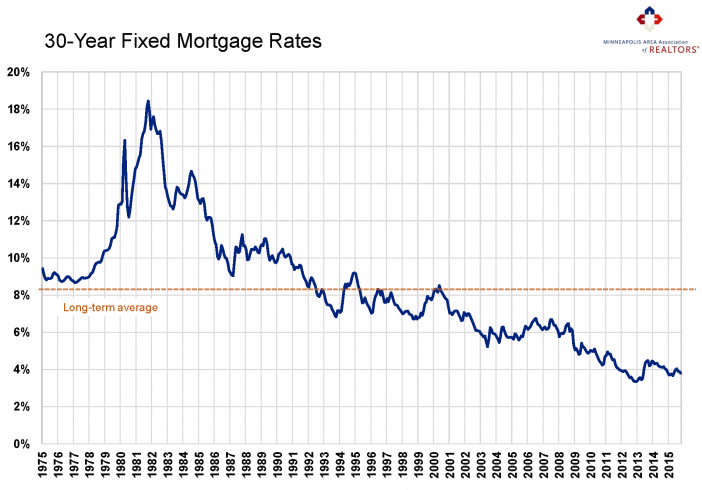

Just what has been the trend with mortgage rates? As the trendline above indicates, mortgage rates have been declining for the last 35 years. They hit a high of 18.5% in 1981 and a 50-year low of 3.3% in 2012, compared to a long-term average of about 8.0%. Many consumers benefited from 30-year mortgage rates below 4.0% between 2012 and 2015. This spurred a lot of refinancing activity in addition to first-time and move-up home buyer purchase activity.

In fact, sales in the 13-county Twin Cities metro area reached a 10-year high in June 2015, no doubt partly triggered by low rates. But what will be the impact of higher (or more normal) rates on our economic recovery, the housing market, savings yields and the stock market? Higher rates aren’t all bad. It means savers will be rewarded more, which will be a positive factor for down payments and consumer financial stability. The economic recovery is accelerating as we’re seeing strong jobs numbers, finally stronger wage growth and consistent GDP growth. Higher rates are unlikely to derail the recovery.

The stock market has begun to price in higher interest rates, but stocks have been quite popular since other investment vehicles aren’t yielding much return due to the rate environment. That could be an area of concern. But the fundamentals remain compelling. Corporate profits near all-time highs, corporate taxes near all-time lows, record valuations driving unprecedented merger and acquisition activity—higher than even the debt-fueled M&A boom before the recession—all suggest the U.S. corporate sector and economy in general will remain an island of stability in a global sea of potential risks.

On the housing side, refinancing activity will likely slow, but there is enough organic and pent-up demand out there to support ongoing housing recovery. Many families chose to stay put and weather the downturn. Some adult children who doubled up with mom and dad will forge their own new households. Many renters frustrated by rising rents will enter homeownership to gain equity and better control their housing costs. Price growth should remain positive but the pace has already slowed and returned to historic norms (+4.0% to +7.0% year-over-year). In 2013, the median sales price increased 14.4% compared to 2012. For 2014, that figure was 7.1%, and for 2015YTD it is 7.0%.

So what happens next? The Fed has limited yet effective tools available at its disposable to implement monetary policy. Through open market operations, the discount rate and reserve requirements, it is able to alter the federal funds rate. This is the key rate at which financial institutions (banks, credit unions) actively trade balances held at the Fed with each other. This usually happens overnight and impacts a variety of financial vehicles, including mortgage rates.

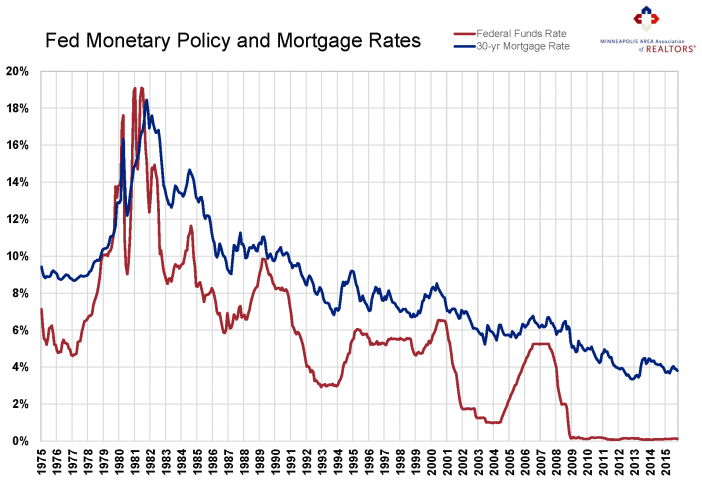

However, a shift in the federal funds rate does not correspond to an equivalent change in the consumer-facing 30-year mortgage rate. The chart above showcases this. Note that large increases in the federal funds rate only correspond to minor and sometimes leading or lagging changes in the mortgage rate. There does seem to be a relationship, but it’s neither as strong nor as direct as many assume.

For example, when the federal funds rate increased from 1.0% to 5.2% between 2004 and 2006, mortgage rates only increased from 5.5% to around 6.5%. In other words, a 420.0% increase in the federal funds rate was only accompanied by a roughly 18.0% increase in rates. That was an unusually large jump in the federal funds rate aimed at slowing an overheating housing market. None of this happens in a vacuum. Many other factors impact mortgage rates, including but not limited to current inflation, future inflation expectations, treasury market dynamics, equity and bond market dynamics, debt levels, the velocity of money, wage pressure, GDP growth, the general economic climate and other forces.

So exactly what does the future hold? Crystal balls are tough to come by these days, but Freddie Mac and others have put out a forecast for mortgage rates through the end of 2016.

Most economists expect 30-year mortgage rates to reach 4.5% or 4.6% by the end of 2016, compared to just under 4.0% at the end of 2015. That’s a manageable increase and is still well below the long-term average of just over 8.0%. To put that in perspective, the total payment on a $200,000 loan at 4.0% vs. 4.5% amounts to a monthly difference of about $50. While that’s certainly noticeable, most households can stomach it—particularly with additional wage growth and stronger labor force participation.

In the face of declining affordability brought on by rising prices and higher rates, the key will be whether wage growth can neutralize or at least partly offset that effect. Furthermore, in today’s low inventory environment, the other trend to watch will be whether prices continue to rise at a sufficient level to motivate hesitant sellers to list without rising so fast so as to alienate buyers. The most budget-sensitive consumers might make an attempt to get deals done sooner than later, but for most consumers, the difference isn’t enough to drastically change behavior.

Ultimately, the future is unwritten. But given the data coming out of the economy, labor and housing markets and the fact that the dream of homeownership is alive and well, we feel pretty confident that the U.S. economy in general and housing in particular will remain a bright spot.

From The Skinny Blog.