What a summer it has been. Home sales reached 10-year highs, prices continued to rise but at a more sustainable pace and interest rates and job growth have both been favorable. With housing, the labor market and the broader economy all performing relatively well, the Federal Reserve seems committed to lifting their key rate off zero by year-end.

As the busy summer season draws to a close, activity levels have begun to cool month-to-month, but most indicators continue to show year-over-year improvement. Pending sales rose 12.2 percent to 5,347 for August, but are up 17.9 percent so far in 2015. Closed sales increased 7.8 percent to 5,811, but have risen 15.7 percent so far this year. Seller activity was flat compared to last year, new listings fell 0.3 percent from 6,945 to 6,922. Inventory levels tumbled 13.6 percent to 16,398 active listings.

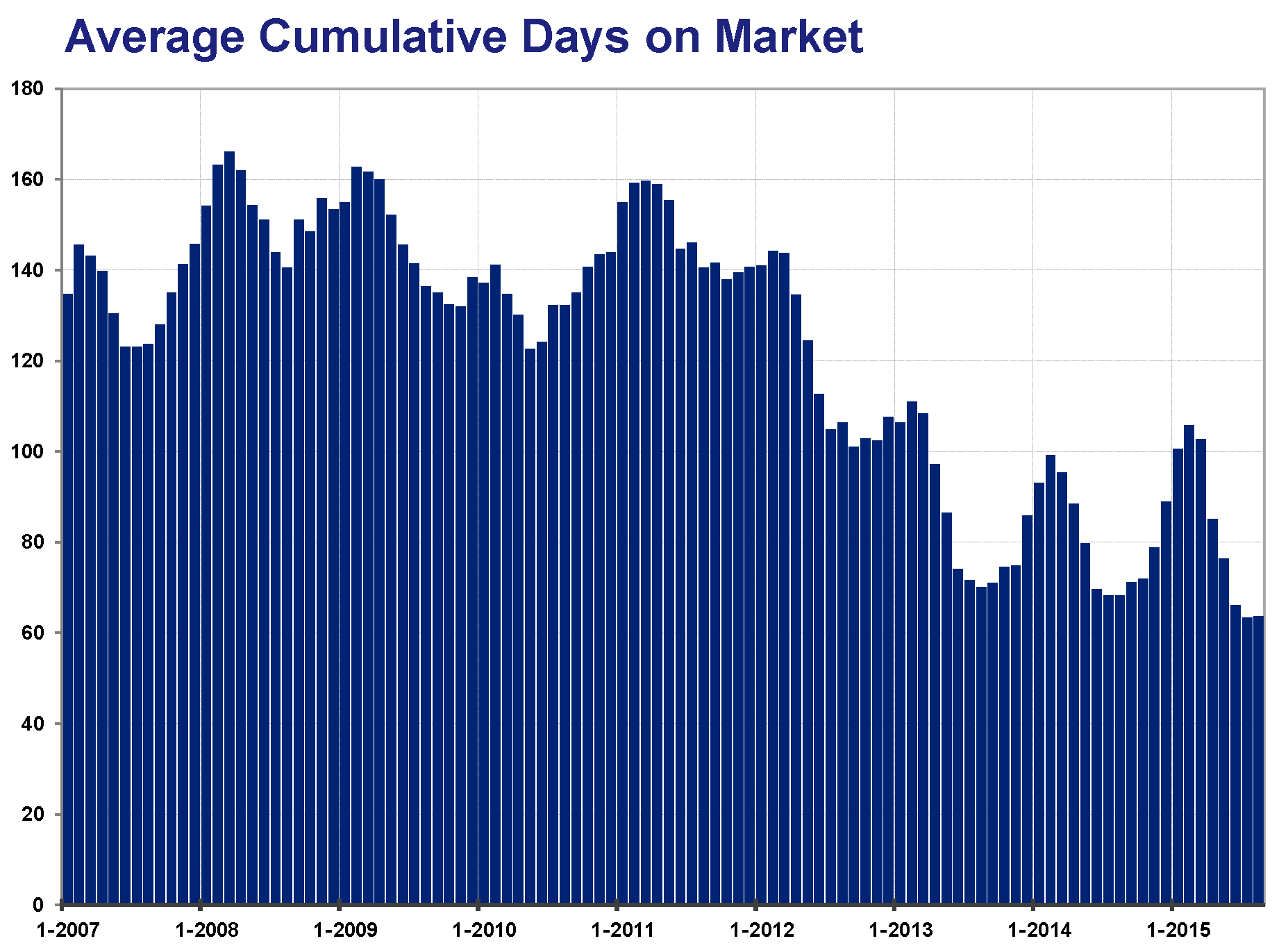

“The August numbers show that homes are selling in near-record time and that sellers are getting close to full list price,” said Mike Hoffman, Minneapolis Area Association of REALTORS® (MAAR) President. “The average time a property spends on the market fell to 64 days, just above the 9-year record pace of 63 days.”

Strong demand combined with low supply levels means homes don’t linger on the market for long. It also means prices are still feeling upward pressure, though to a lesser extent compared to the initial phases of recovery. The August 2015 median sales price rallied 2.7 percent to $224,900. The average price per square foot also increased 2.7 percent to $129. Sellers are accepting offers at a median of 98.0 percent of their original list price but 99.3 percent of their final list price, which indicates near-full price offers arrive quickly once the home is priced right.

The Twin Cities region has 3.5 months’ supply of inventory, which means sellers are firmly in the driver’s seat. That figure sank 23.9 percent since August 2014. However, not all local areas, market segments and price points reflect that metropolitan-level reality.

During August, mortgage rates hovered just under 4.0 percent, compared to a long-term average of over 7.0 percent. The Department of Commerce reported that national construction spending rose to its highest level in seven years. The economy added 173,000 new private payrolls in July while the unemployment rate fell to 5.1 percent. The latest Bureau of Labor Statistics figures show the Minneapolis-St. Paul-Bloomington metropolitan area had the second lowest unemployment rate of any major metro at 3.7 percent.

“Anxiety surrounding interest rates might be overblown,” said Judy Shields, MAAR President-Elect. “Yes, we have likely seen the bottom in terms of mortgage rates. But they will go up very slowly and incrementally and won’t affect the typical borrower very much. We see it as a positive sign that our economy has improved and is resilient enough to withstand it. We’ve come a long way and we knew this was coming.”

From The Skinny Blog.