While you’re eating better and exercising more, also resolve to better understand the inner workings of your housing market. Data does not have to be daunting. Just from the existing trends, it’s safe to expect to see more homes selling in less time for closer to list price. It also looks like the single-family detached segment may recover faster than the condo-townhouse attached segment. It would be wise to watch foreclosure activity to see whether there will be fewer low-priced sales in 2013. Many patterns emerge if you look in the right places. In the Twin Cities region, for the week ending December 22: For the month of November: Click here for the full Weekly Market Activity Report.From The Skinny.

As we celebrate with family and friends this holiday season, we can take comfort in the fact that housing markets across the country are reaching their own holiday milestones. Even though the trend is our friend, recovery can often feel piecemeal: fewer foreclosures here, improved absorption rates there and lower days on market over there. But, overall, we’ve struck a positive stride, and momentum has a way of accumulating. Here’s a peek at the week’s housing market data. In the Twin Cities region, for the week ending December 15: For the month of November: Click here for the full Weekly Market Activity Report.From The Skinny.

Where has the Twin Cities real estate market been and where is it heading? This monthly summary provides an overview of current trends and projections for future activity. Narrated by Andy Fazendin (2012 President-Elect, Minneapolis Area Association of REALTORS®), video produced by Chelsie Lopez.

The chase to 2013 is on, and we are pleased by the prospects ahead. Given the upward progress of the 2012 housing market, many homeowners may find that their properties will be worth more next year. That’s a nice change of pace for potential sellers, and for residential real estate as a whole, and is a direct result of widespread improvements in the marketplace. Most of the positive trends we have seen in 2012 should persist into the new year. Let’s take a peek at what’s happening locally today. In the Twin Cities region, for the week ending December 8: For the month of November: Click here for the full Weekly Market Activity Report.From The Skinny.

Despite the dramatic arrival of winter, the housing market has retained much of its summer heat. Three decisive trends continued through November: Buyer activity outperformed year-ago levels, inventory dropped and, for a ninth consecutive month, home prices rose compared to 2011. In simpler terms, more homes sold in less time at higher prices and for closer to asking price than last year. During November, 3,843 homes closed, 20.0 percent higher than November 2011. There were 3,587 pending sales, a 12.6 percent increase over last year.

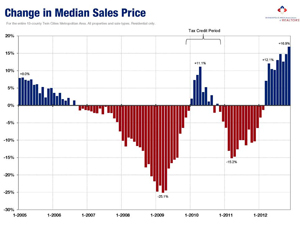

The median sales price was up 16.9 percent to $173,000. The 10K Housing Value Index showed a more modest 9.1 percent increase to $173,113. The number of homes for sale fell 29.4 percent to 13,860 active listings – the lowest number since January 2003. Consequently, seller sentiment has become even more critical to housing recovery. There is evidence of improvement on this front.

The median sales price has risen for nine consecutive months. Less supply, more demand and a healing distressed segment have enabled this trend. Overall, new listings were up 0.2 percent. However, traditional new listings were up 27.8 percent while foreclosure and short sale new listings fell 21.1 and 45.7 percent, respectively. Thus, a pullback in bank-mediated listings has diluted a significant increase in traditional seller activity.

Similarly, closed sales were up 20.0 percent overall, but traditional sales were up 50.4 percent while foreclosures and short sales were down 14.9 and 2.7 percent, respectively. As for the shifting market share, traditional sales made up 64.2 percent of sales, foreclosures 24.6 percent and short sales 11.2 percent.

Months’ supply of inventory fell 40.6 percent to 3.4 months. Figures below 4.0 months of supply are typically hallmarks of sellers’ markets. Homes tended to sell in 104 days, on average, 25.9 percent quicker than last year. Sellers received 94.3 percent of their list price, on average, up from 90.9 percent last year. Conventional financing comprised 48.5 percent of all closed sales; FHA financing was used on 23.1 percent of sales; cash buyers made up 20.6 percent of sales.