Recovery continued across the Minneapolis-St. Paul metropolitan housing market even with our first taste of fall weather. Sellers regained some enthusiasm as new listings rose 19.3 percent to 6,372, marking the sixth consecutive year-over-year increase in monthly seller activity.

Buyers closed on 4,667 homes, a 14.5 percent increase over last September. Consumers have 15,968 properties from which to choose – 7.1 percent fewer than September 2012 but 22.5 percent more than in January 2013.

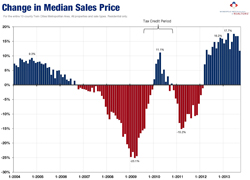

The overall median sales price stood at $195,000, up 11.7 percent compared to September 2012. Three factors have coalesced to attain higher sales prices: less supply, more demand and a sales mix that’s returning to traditional sales and away from foreclosures.

In September 2011, foreclosures and short sales together comprised 46.1 percent of all closed sales. In September 2013, these two segments made up only 21.9 percent of sales.

“Median sales prices have increased for 19 consecutive months in year-over-year comparisons,” said Andy Fazendin, President of the Minneapolis Area Association of REALTORS® (MAAR). “Rising rents, affordable prices and low interest rates continue to drive sales increases.”

While closed sales were up 14.5 percent overall, traditional buyer activity was up 37.3 percent. Foreclosure sales and short sales were down 27.3 and 30.0 percent, respectively.

Similarly, new listings were up 19.3 percent overall, but traditional seller activity rallied 42.6 percent higher as foreclosure and short sale new listings fell 29.6 and 42.6 percent, respectively.

Homes are selling in an average of 71 days, continuing a low-number trend from last month that we haven’t seen around here for more than six years. Sellers are receiving an average of 96.5 percent of their original list price – the highest September ratio since 2005. The Twin Cities is at 3.6 months’ supply of inventory for September 2013.

The traditional median sales price rose 4.4 percent to $217,000; the foreclosure median sales price was up 8.0 percent to $134,900; the short sale median sales price increased 10.9 percent to $145,250.

“With price gains continuing and multiple-offer situations still common, market recovery and stability has been the order of the day,” said Emily Green, MAAR President-Elect. “Activity should begin its season slowdown, but we expect year-over-year activity to remain positive.”