For Week Ending September 30, 2017

Few cities and neighborhoods – around the nation and locally – are turning heads as hotbeds of new housing inventory. Residential real estate markets that have had a hard time dealing with a reduction in the number of homes available for sale are now also struggling to keep up with new listings levels from last year. While it’s true that builder confidence is up, it will take time before any sort of new development spawns a significant change in trend direction.

In the Twin Cities region, for the week ending September 30:

- New Listings decreased 4.9% to 1,382

- Pending Sales decreased 0.9% to 1,160

- Inventory decreased 16.0% to 12,728

For the month of August:

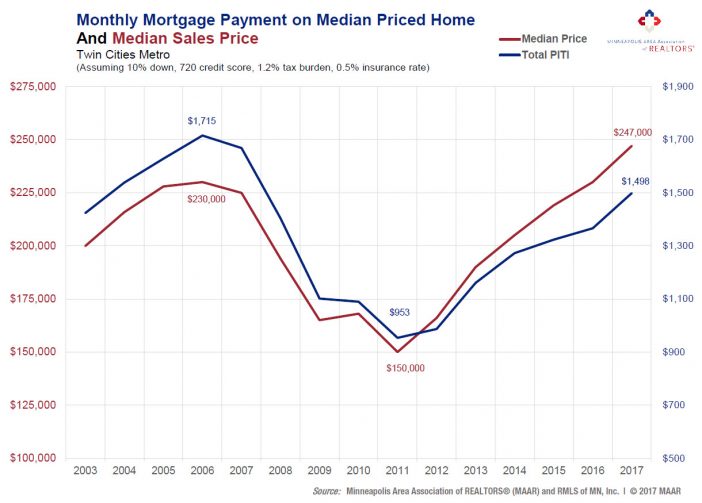

- Median Sales Price increased 6.8% to $252,000

- Days on Market decreased 14.3% to 48

- Percent of Original List Price Received increased 0.6% to 98.5%

- Months Supply of Inventory decreased 16.7% to 2.5

All comparisons are to 2016

Click here for the full Weekly Market Activity Report. From The Skinny Blog.