The Twin Cities were once again buzzing with housing activity in July. Rising rents combined with still-favorable prices and mortgage rates have resulted in ongoing housing recovery. House hunters continue to eye seller activity for hints of additional inventory. New listings rose a healthy 24.6 percent, the second-largest gain since April 2010. Buyers have 15,671 properties from which to choose – 13.0 percent fewer than in July 2012 but still marking the smallest year-over-year decline in inventory in more than two years.

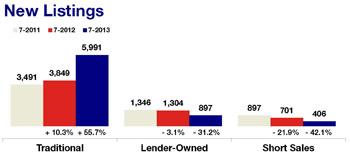

The overall median sales price was $208,757, up 17.2 percent compared to July 2012. A shift in sales type is driving this price growth. As recently as July 2011, foreclosures and short sales together comprised 45.4 percent of all sales activity. In July 2013, these two distressed segments made up just 20.6 percent of all sales. On the seller side, the percentage of all new listings that were distressed in July fell to 17.9 percent, down from 41.2 percent in July 2011.

New listings were up 24.6 percent overall, but traditional seller activity surged 55.7 percent – the most in nearly ten years. Foreclosure new listings decreased 31.2 percent and short sale new listings fell 42.1 percent. With 17 straight months of year-over-year median price gains, multiple-offer situations and just 3.6 months’ supply of inventory, the same market that recently favored buyers is now tilting toward sellers. Homes are selling in an average of 72 days – the quickest pace in six and a half years. Sellers are receiving an average of 97.5 percent of their original list price – the highest ratio in just over seven years.

The traditional median sales price rose 3.6 percent to $224,900; the foreclosure median sales price was up 11.6 percent to $135,000; the short sale median sales price increased 18.6 percent to $153,000. On average, traditional homes sold in 62 days for 97.6 percent of original list price, foreclosures sold in 83 days for 98.3 percent of original list price and short sales lagged at 166 days and 93.8 percent of original list price.