Minneapolis, Minnesota (November 12, 2013) – The Minneapolis-St. Paul metropolitan housing market continued along the path toward recovery in October. While some measures suggest a slowing in the pace of recovery, this

deceleration is primarily the result of a healing distressed segment. Sellers felt more confident as new listings rose 15.1 percent to 6,102, marking the seventh consecutive year-over-year increase in monthly seller activity. Buyers

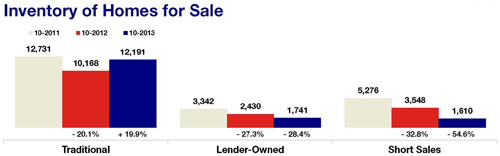

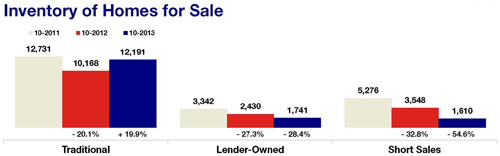

closed on 4,495 homes, a modest 1.9 percent increase over last October. Consumers have 15,556 properties from which to choose – or just 3.7 percent fewer than last October, but 19.2 percent more than in January 2013.

The market-wide median sales price was unchanged from September 2013 at $195,000, but was up 11.4 percent compared to October 2012. In October 2011, foreclosures and short sales together comprised 46.2 percent of all closed

sales. In October 2013, these two segments made up only 21.5 percent of all sales. For new listings, the same October figure dropped from 42.4 percent in 2011 to 19.5 percent of all new listings in 2013.

“The slight decrease in pending sales activity is entirely attributable to declines in the number of contracts signed on foreclosure and short sale properties,” said Andy Fazendin, President of the Minneapolis Area Association

of REALTORS® (MAAR).

Traditional pending sales activity was up 19.7 percent while foreclosure and short sale contracts were down about 33.7 and 50.8 percent, respectively. Closed sales increased 1.9 percent overall, but traditional closed sales rose 23.6

percent. Foreclosure sales and short sales were down 32.9 and 50.0 percent, respectively. New listings rose 15.1 percent overall, but traditional seller activity increased 39.0 percent higher as foreclosure and short sale new

listings fell 24.4 and 50.1 percent, respectively.

On average, homes are spending 75 days on the market – the quickest October pace in seven years. Sellers are receiving an average of 95.8 percent of their original list price – the highest October ratio since 2006. The Twin Cities

metro now has 3.5 months’ supply of inventory, which suggests sellers are regaining their leverage.

“We are within the final phases of market recovery,” said Emily Green, MAAR President-Elect. “Supply levels are stabilizing and regenerating, which means buyers have more choices and balance is being restored.”

All information is according to the Minneapolis Area Association of REALTORS® (MAAR) based on data from NorthstarMLS. MAAR is the leading regional advocate and provider of information services and research on the real estate industry for brokers, real estate professionals and the public. MAAR serves the Twin Cities 13-county metro area and western Wisconsin. 10K Research and Marketing, LLC is a wholly owned subsidiary of MAAR.